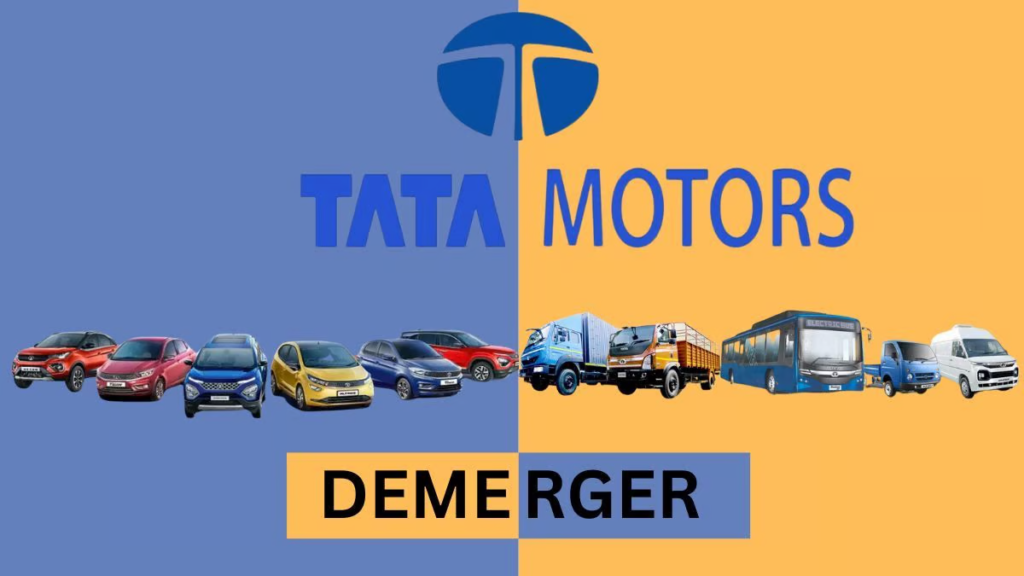

Tata Motors Ltd’s (TML) board of directors accepted a plan on Monday to split the automobile manufacturer into two distinct separate listed companies. The plan says, one entity will look over the commercial vehicles (CV) business and its connected investments. Apart, the other will include the passenger vehicles (PV) businesses. PV business include domestic PV, electric vehicles (EV), Jaguar Land Rover (JLR), and their related investments.

According to observers and analysts, this is the ideal time for the corporation to separate its PV and CV businesses. This will free up value for the EV sector. However, they do not see this action as a forerunner to listing the JLR and EV businesses independently at a later date.

How the Demerger would occur?

The release occurred after the market had closed. On the BSE, the TML (Tata Motors Limited) stock finished the day’s trading slightly down at Rs 987.2 a share.

The National Company Law Tribunal (NCLT) established scheme of arrangement will be used to carry out the demerger. All TML shareholders will have the same shareholding in both listed corporations.

The NCLT form of arrangement for the demerger will be brought to the TML board of directors for approval in the coming months. However, it will be conditioned on shareholder, creditor, and regulatory clearances, which may take another 12-15 months. The corporation stated that the demerger will not have a negative impact on employees, customers, or business partners.

Key Points Of Tata Motors Demerger

The company’s shares will be divided in 1:1 ratio. Investors will receive one share of each newly listed entity for every share they own in Tata Motors.

According to the corporation, the decision was made to pursue the respective strategies of the two segments. They added this was necessary to achieve stronger growth, agility, and greater responsibility.

The NCLT scheme of arrangement for the demerger will be presented to the company’s board for approval in the coming months. Further, the company stated ‘the demerger will have no negative impact on staff, clients, or business partners’.

What Impact Demerger would have?

According to UBS, Tata Motors’ demerger streamlines its structure but does not result in unleashing of significant value. The brokerage house has a ‘Sell’ recommendation on Tata Motors with a target price of ₹600 per share.

Morgan Stanley stated that the demerger underlines the company’s belief in the PV segment’s self-sufficiency and might lead to increased value creation for Tata Motors. The firm has a target price of ₹1,013 for the stock.

Nuvama Institutional Equities feels the demerger will have little immediate impact. However, the brokerage firm predicts that after the demerger is completed, and the smaller corporation (CV business) becomes an independent organization, it would quit the Nifty 50 and Sensex.

The company further added, “Think of it like JIO’s recent demerger from Reliance Industries, where JIO got listed separately and eventually (in the next few days) got excluded from the domestic indices.”